Facts About What Is Medigap Revealed

Table of ContentsRumored Buzz on MedigapHow Does Medigap Works Things To Know Before You BuyAll About What Is MedigapIndicators on Medigap You Need To KnowThe Buzz on Medigap Benefits

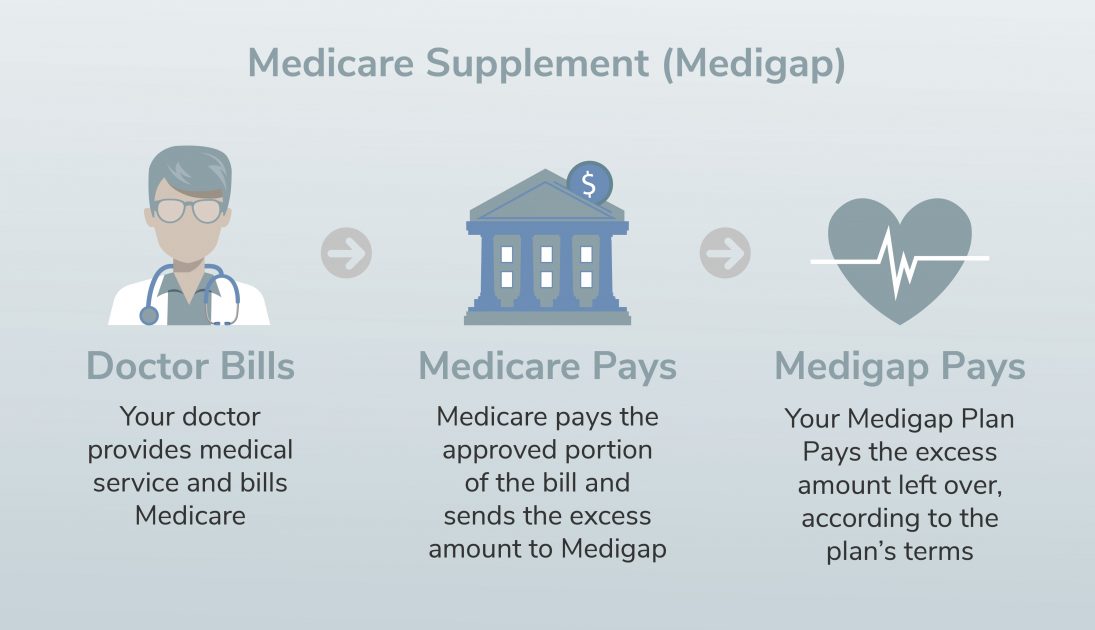

If you are covered by a health insurance provided via PEBA as well as you become Medicare-eligible for any type of reason, not simply age, you will have the ability to change to the Medicare Supplemental Strategy within 31 days of eligibility. Hereafter 31-day period, you can transform from the Standard Plan to the Medicare Supplemental Strategy during the yearly October open enrollment duration.Medicare Select is a type of Medigap plan that requires insureds to utilize details hospitals as well as in many cases details physicians (except in an emergency situation) in order to be qualified for full advantages. Aside from the restriction on hospitals as well as suppliers, Medicare Select plans need to meet all the demands that put on a Medigap policy.

When you utilize the Medicare Select network health centers as well as providers, Medicare pays its share of authorized fees and also the insurance business is in charge of all supplemental advantages in the Medicare Select plan. Generally, Medicare Select policies are not required to pay any type of advantages if you do not make use of a network provider for non-emergency solutions.

The 25-Second Trick For Medigap

What truly amazed them was the realization that Medicare would certainly not cover all their healthcare expenses in retired life, including those when taking a trip abroad. "We travel a great deal and also desire the safety and security of recognizing we can get clinical treatment away from home," states Jeff, who with Alison is expecting visiting her family members in England.

The Ottos realize that their needs might alter over time, especially as they stop itinerary as they age. "Although we have actually seen boost over the last 2 years given that we enlisted in Medigap, we have the ideal level of supplemental insurance coverage in the meantime and also think we're obtaining great value at $800+ per month for the both people consisting of dental insurance coverage," stated Alison.

For residents in pick states, enlist in the best Medicare prepare for you with assistance from Fidelity Medicare Solutions.

The smart Trick of Medigap Benefits That Nobody is Talking About

Yet we can offer you a basic concept. As well as, regrettably for your child, maybe a rather considerable drop depending on just how late he was with the settlements. According to the web site Credit Fate, someone with a credit history comparable to your child's will see anywhere from a 25 to 85-point decline a fantastic read if a charge card settlement is greater than 1 month late.

The only method to claw his back to around 690 is to begin making settlements in a timely manner (and, ideally, completely), in addition to just using regarding 10 to 30 % of his available credit report monthly (What is Medigap). As well as he needs to be individual: Credit rating healing time from missed out on repayments typically takes about 18 months.

Medicare Supplement Strategy N minimizes just how much Original Medicare enrollees need to pay out of pocket for health and wellness treatment. Plan N pays 100% of the coinsurance for hospitalization (Medicare Component A) and also clinical treatment (Medicare Part B). Plan N, one of 10 Medicare Supplement or Medigap plans, provides greater insurance coverage than a lot of the other supplementary plans on the market.

10 Easy Facts About How Does Medigap Works Described

Among other advantages, Plan N covers the coinsurance expenses for Medicare Part A, Medicare Component B, hospice treatment as well as proficient nursing facilities. This indicates that as opposed to an enrollee being billed 20% of the bill, as would certainly occur with Initial Medicare, the additional strategy would pay that 20% of the costs.

It is important to note, nonetheless, that plans marketed by insurance coverage companies are standardized throughout the country, suggesting a Plan N policy offered by Aetna covers the exact same core advantages as a Plan N plan sold by Cigna or a different carrier. Medicare Parts An and B pay their share of clinical expenditures, normally 80% of costs.

Its copays do not count toward fulfilling the Part B insurance deductible. Most Strategy N policies do not bring a separate insurance deductible other than the Component B deductible. Plan N likewise does not cover Medicare Component B excess costs the quantity service providers can bill over Medicare costs if they do decline Medicare-approved prices.

We important source advise Strategy N if you desire reduced monthly costs and want to have some costs for healthcare like medical professional consultations. Strategy G is a much better choice if you're willing to pay more each month for a plan that gives the most thorough insurance coverage for brand-new enrollees.

Little Known Questions About Medigap Benefits.

With Plan N, low-end individuals of wellness services may come out ahead. Premium customers of wellness treatment services will have a different straight from the source experience. Let's state, for instance, that a Strategy N sets you back $150 in monthly premiums while a Strategy G costs $200 a month, resulting in $50 monthly in cost savings for Strategy N.

Comments on “All about Medigap Benefits”